A record of cumulated claims of the German Central Bank in the EURO-system of almost EURO 1,000 Billion has been reported by the President of the European Central Bank (ECB) Marion Draghi. The new TARGET 2-report has enhanced again a crucial political dispute on the dimension of the risks and the negative impact of the monetary policy of the ECB on German taxpayers, if debtor countries like Italy and Greece fail to reimburse their liabilities. Mario Draghi, however, argues that the present disparities in the EURO-zone have mainly a technical dimension resulting from the settlement of cross border payments, which are operated by the digitized TARGET 2-system. The implied risks and the negative impact of the ECB policy seem to be neither made adequately transparent nor sufficiently assessed. The poor transparency and control of the banking system has once motivated Murray N. Rothbard from the Austrian Economic School to express his general critics on the banking system in his publication “Mystery of Banking” decades ago. A reprint of the book was published in the year of the financial crisis.

The controversial discussed TARGET 2 report refers to bookkeeping results registered by the Trans-European Automated Real-time Gross Settlement Express Transfer System 2. This is a fully digitized system to settle cross-border payments due to foreign trade transactions, cross-border services and the sovereign bond purchases by the ECB. In 2017, about 89 Million cross-border payment transactions and a total turnover of €433 Trillion have been indicated by the ECB.

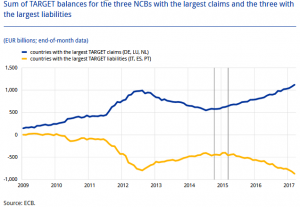

The present dispute of politicians, academics and the media is focusing on the cumulated claims position of the German Central Bank of nearly EURO 1,000 Billion. Many critics are referring to the expertise of the former President of the ifo-Institute, Werner Sinn. He is criticizing the gigantic dimension of financial support for the benefit of economically weak performing countries of the EURO-zone such as Italy, Greece, Spain, Portugal, and Ireland. He fears the implied risks, if the debtor countries fail to reimburse their liabilities hold as claims by the Euro-system. Critics fear also losses of private households, banks, and insurance companies holding sovereign bonds especially from Greece and Italy. Increasing disparities of income and wealth by the increase of asset prices and a destabilizing threat on the real economy are crucial issues, too. Doubts on the legitimacy of the ECB monetary policy of Mario Draghi have been expressed as well. (Figure 1)

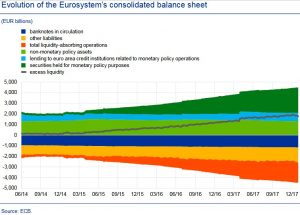

ECB-President Mario Draghi defends his monetary policy and argues the present disparities of the TARGET 2 payment settlements are mainly a result of the Bond Purchasing Programs of the European Central Bank to fuel liquidity into the EURO-zone. He argues that risks can only arise, if the debtor countries fail to pay interest on their sovereign bonds. Mario Draghi also refers to the mandate of the ECB: “the Quantitative Easing Policy of the ECB is to encourage investment in the economies of the EU member states.” He argues the poor performing countries “need liquidity” and “the creation of that gigantic amount of new money is needed urgently for stabilizing the finance system in the Euro zone.” (Figure 2)

The German Economic Advisers to the Government criticize the extraordinary expansion of money supply of the ECB combined with negative interest rates, as such a monetary policy encourages inefficient and short termed business and investment. The advisers fear a growing unproductive allocation of resources in Germany and Europe due to that gigantic liquidity inflow. For long, Jens Weidmann, the President of the German Central Bank and Director of the ECB, is opposing to the ECB policy. He is criticizing negative interest rates and bailouts for rescuing banks and governments in Europe. He urges “that the work of central banks be brought back to the traditional field of monetary policy and that a clear distance to fiscal policy measures be maintained.”

After interviewing 80,000 private households in Europe on property and income issues, the ECB-President has to admit growing disparities between poor and richer private households: “Euro area households that hold financial assets, such as stocks and bonds, are strongly concentrated at the top end of the net wealth distribution.” He adds: “only a fairly small subset of the population benefits from capital gains in equity and bond markets.” The ECB seems to neglect the impact of the liquidity inflows on real estate prices followed by increasing housing rents. The OECD confirms the ECB results by own surveys. Security experts of the NATO meanwhile concerned with the challenge fear political and social tensions by the indicated disparities of income and property in Europe.

Decades ago, there have been already controversial debates between politicians, academics, and bankers on the economic impact of an uncontrolled creation of money by the banking system, of an ongoing public deficit spending, and of a continuous balance of payments surplus (Germany) or balance of payments deficit (Greece, Italy) in Europe. Market oriented politicians and academics have identified public debt and public deficits as crucial drivers of the expansion of money supply worldwide. In the 80ties, Susan Strange called this expansionary policy Casino Capitalism. Monetarist Milton Friedman recommended first to decrease public deficits and second to return to the gold standard as coverage of sovereign bonds and currency to prevent an ongoing increase of public debt and budget deficits. However, former US-FED Director Allan Greenspan, defended the expansionary monetary policy of Central Banks: “in a market economy rising debt goes hand in hand with progress,”

Up to date the implied risks of the ECB policy and its economic impact seem to be neither transparent nor being monitored and sufficiently assessed. Moreover, the Panama Papers and the Paradise Papers published by The Guardian confirm Murray N. Rothbard’s publication “The Mystery of Banking.”

This contribution summarizes the article The Mystery of Banking, Money Supply, and Deficit Spending, written by the author, published in the US-American Journal of Economic Development, Management, IT, Finance and Marketing in March 2018 pp 14-27, and edited by Professor Matthew Kuofie from the Michigan University (USA) and CEO of the Global Strategic Management Inc. and a member of the Advisory Board to the President of the USA, Donald Trump.

———————————————